XCore Solutions

Key Components

Integrations

PrimeXM’s XCore solution is integrated with over 120 industry leading liquidity sources, including tier-one banks, ECNs and Exchanges.

Aggregation

PrimeXM’s XCore's

solution supports multi-tiered best bid/offer aggregation, leading to better spreads and superior execution.

Risk Management

The XCore offers

great flexibility for a-book, b-book and custom execution models, allowing clients to fine-tune their settings.

Web Trader

PrimeXM has developed

a state of the art trading interface, enabling clients to offer more to both their professional traders and institutional clients alike.

Monitoring

PrimeXM’s monitoring components enable clients to track all actions and activity in real-time, through the many dashboards and log viewing tools included in the XCore interface.

Reporting

The reporting interface, a part of PrimeXM’s XCore high performance solution, provides clients with dedicated and customised reporting and analysis of their trading data.

Bridging

PrimeXM’s MT4 Bridge and MT5 Gateway is a powerful yet light-weight server side plugin which connects MT4 and MT5 platforms to the client’s XCore order management and reporting engine.

Analytics

PrimeXM MT Analytics is a powerful reporting and analytics tool, that allows users to run a variety of trade reports for a specified time interval.

Integrations

between industry leading platforms and front ends and over 120 liquidity sources

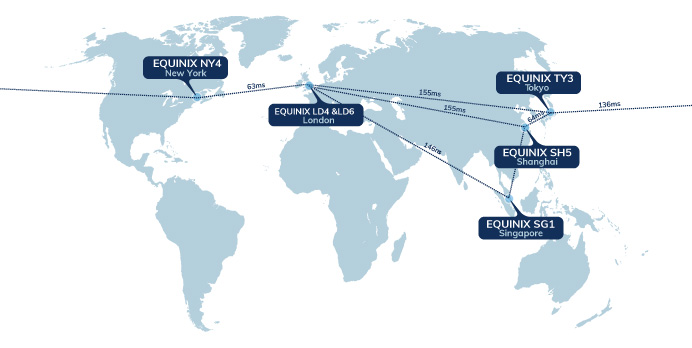

PrimeXM’s XCore solution is integrated with over 120 industry leading liquidity sources, including tier-one banks, ECNs and Exchanges. This gives clients the freedom to choose any liquidity partners and venues they wish without technology constraints. PrimeXM’s purpose built infrastructure facilitates low latency connectivity to these sources, with its robust direct dedicated fiber links and cross connects.

Exchanges

List of Exchanges (Stocks)

More Exchanges supported via Data Vendors: ICE Data Services (full range of Exchanges supported) dxFeed (full range of Exchanges supported) TT – Trading Technologies (full range of Exchanges supported)

Aggregation

of liquidity leading to better spreads and superior execution

PrimeXM’s XCore solution supports multi-tiered best bid/offer aggregation, leading to better spreads and superior execution. Clients can take advantage of the variety of supported providers to create an optimal mix of multi asset liquidity. An unlimited number of liquidity pools can be customised on a per symbol and time frame basis.

Smart Order Routing

The XCore supports complex and dynamic routing rules, which can be tailored for different clients, symbols, order types, trade sizes, target LPs, etc. An unlimited number of markup profiles can be defined and customized on a per symbol and time frame basis, ensuring optimal settings for different offerings and market conditions.

Benefits of XCore Liquidity Aggregation

- Aggregate prices across any number of liquidity providers

- Fully aggregated market depth across liquidity providers

- Create a more competitive environment for your clients through a greater number of liquidity providers

- Access to competitive liquidity, even during volatile periods

- Support multi asset classes

- Sweep the book, ensuring the best VWAP (Volume Weighted Average Price)

Risk Management

with sophisticated risk management controls

XCore offers great flexibility for a-book, b-book and custom execution models, allowing clients to fine-tune their settings. All changes are applied in real-time and trade flows can be switched between execution modes seamlessly. Through extensive reporting capabilities, the platform provides visibility over all trade flows, enabling brokers to efficiently monitor and manage their books.

Additional comprehensive risk management settings, such as setting limits on individual currency exposure, symbol exposure, and the level of risk being internalised or sent to external LPs (Liquidity Providers), are also available.

Key Features

- Set global limits, per symbol, per currency & time-frame exposure limits

- Client flow netting, whilst remaining within pre-defined risk limits

- Monitor risk parameters in real-time

- Manually intervene to offset risk to LPs

- Automatically overflow risked volume to LPs

- Track in real-time any volume sent to LPs as overflow

- Ability to configure and manage a-book exposure with LPs

- Limit exposure during particularly volatile times, such as major news events

PrimeXM has developed a state of the art trading interface, enabling clients to offer more to both their professional traders and institutional clients alike. With flexible layouts, reporting and real-time position tracking, this intuitive trading interface offers PrimeXM’s clients the opportunity to set themselves apart from the competition with this one-stop solution for multi-asset trading.

(Click Video to Enlarge)

PrimeXM has developed a state of the art trading interface, enabling clients to offer more to both their professional traders and institutional clients alike. With flexible layouts, reporting and real-time position tracking, this intuitive trading interface offers PrimeXM’s clients the opportunity to set themselves apart from the competition with this one-stop solution for multi-asset trading.

Key Features

- Intuitive user friendly interface

- Customisable layouts, tailored to meet everyone’s needs

- Advanced market watch feature, containing market depth

- Real-time position snap shot, including margin and running PnL

- Historic position reporting and statistics

- Support for multiple order types

- Advanced trade request options, including time to live and price deviation

- Intuitive user friendly interface

- Customisable layouts, tailored to meet everyone’s needs

- Advanced market watch feature, containing market depth

- Real-time position snap shot, including margin and running PnL

- Historic position reporting and statistics

- Support for multiple order types

- Advanced trade request options, including time to live and price deviation

PrimeXM’s monitoring components enable clients to track all actions and activity in real-time, through the many dashboards and log viewing tools included in the XCore interface, but also via the real-time email notifications. Clients can track connector and provider connections, as well as pricing and trading activity.

Whilst real-time tracking is vital for day to day operations, PrimeXM’s monitoring capability also extends to historic analysis. This enables clients to review all historic log activity to trace past trade and pricing activity and also historic connectivity to providers and connectors. As such, investigation, be it to help resolve a technical issue or provide clarity to a client around a specific trade event, is made easier.

This powerful feature comes with a host of functions which are all accessible via the same interface and are easy to use and configure.

Key Features

- Real-time tracking of every activity, including – price actions, trade actions, settings and connector status

- Custom automated email alerts to notify your team when there might be a problem

- Monitor connector and LP connectivity status in real time

- Historic access to all log files for a retrospective view of trading activity and connectivity stability

- Download or export all information for further analysis or reporting

- Validate configuration changes in real time

The reporting interface, an integrated part of PrimeXM’s XCore high performance solution, provides clients with dedicated and customised reporting and analysis of their trading data. Detailed custom reports can be generated and data can be precisely filtered and exported, giving the user valuable insight into both their trading activity and setup efficiency. Such reports focus on every aspect of the trading environment,including slippage, execution times, real-time positions, rejections and gains. Users have the ability to drill down to the level of individual order and trade activity, or group data to create the perfect management summary reports.

XCore’s integrated and intuitive reporting module provides customised and extensive analysis, allowing real-time insight into every aspect of the trading environment.

Our reporting system can reflect all aspects of trading, including slippage, time elapsed during trading, real-time net positions, transaction status, accurate to each trading product, branch of each order, and so on. In addition, users can also perform macro data statistics and generate statistical reports.

Key Features

- Custom reports for in depth analysis and insight

- Create comprehensive management reports

- Export custom reports for regulatory reporting

- Book snapshot report for specific deal analysis

- Analyse specific data and trading activity for risk management purposes

- Analyse statistics across custom data sets

PrimeXM’s MT4 Bridge and MT5 Gateway is a powerful yet light-weight server side plugin which connects MT4 and MT5 platforms to the client’s XCore order management and reporting engine. Sophisticated synchronization mechanisms ensure consistency between MetaTrader platforms and the XCore; while full support for parallel processing allows maximum throughput at low latency.

Complex execution rules can be configured in real time, and fine tuned to the level of individual MT4 and MT5 accounts, symbols, order types without the need of server restart.

Key Features

- Ultra-light weight server side plugins

- Full support for parallel processing

- Capable of processing thousands of trades per second

- Sophisticated synchronization between MetaTrader and XCore

- Complex order routing capabilities

- Partial fill and sweep the book capabilities

PrimeXM MT Analytics is a powerful reporting and analytics tool, that allows users to run a variety of trade reports for a specified time interval. It also offers valuable business insight through real-time positions and exposure monitoring, client profiling based on trading activity for all trades processed within the MetaTrader Server for any combination of groups and accounts.

Key Components

- Generate Orders Reports i.e for closed trades, two entries will appear for each side of the trade

- Generate Trades Reports i.e for closed trades, one entry will appear for both sides of the trade

- Real-Time tracking and monitoring of accumulated open position

- Real-Time tracking and monitoring of currency exposure

- Real-Time tracking and monitoring of Value at Risk (VaR)

- Client profiling and classification based on historical trading activity

We are here to help you!

We take a consultative approach to help identify the most elegant solution for your business or can answer any queries about our products and services. Request a call back and a member of our team will be in touch.